Time spent in Food and Drink apps up 65 per cent year-on-year according to data.ai

Lexi Sydow, Head of Insights at data.ai, rounds up the highlights of the company’s latest report into The State of Food & Drink on mobile.

Earlier this week, we at data.ai (formerly App Annie) released our latest report, which looks at the State of Food & Drink on mobile with unprecedented granularity. The data in the report comes from App IQ, our analytics platform that breaks the app landscape down into a granular, industry-first, robust taxonomy, consisting of 19 genres – such as Social Media, Health & Fitness, Books & Reference, and Shopping – and 152 subgenres across both app stores.

Earlier this week, we at data.ai (formerly App Annie) released our latest report, which looks at the State of Food & Drink on mobile with unprecedented granularity. The data in the report comes from App IQ, our analytics platform that breaks the app landscape down into a granular, industry-first, robust taxonomy, consisting of 19 genres – such as Social Media, Health & Fitness, Books & Reference, and Shopping – and 152 subgenres across both app stores.

Within each, App IQ identifies all features of the app, from monetisation methods to social features, app marketers can see how their app stacks up against the competition through multiple lenses. Data available for each app includes the number of downloads; the change in the number of downloads in a given time period; revenues and change in revenues.

For this report, we took a deep dive into seven Food & Drink subgenres, including Food Delivery & Carryout, Ultrafast Delivery, Grocery Delivery, Restaurants & Bars, Cooking & Recipes, Ratings, Reviews & Reservations, and Other Food & Drink, with the aim of helping publishers to succeed on mobile in 17 markets.

Report Highlights

Demand for mobile-first food services reached a new high in Q1 2022, with time spent in Food & Drink apps globally growing 65 per cent YoY. The global growth rate of sessions grew 8x faster than downloads, showing habits formed during peak COVID quarantine periods are more ingrained than ever. India remained the number one market, accounting for almost 20 per cent of time spent in Food & Drink apps.

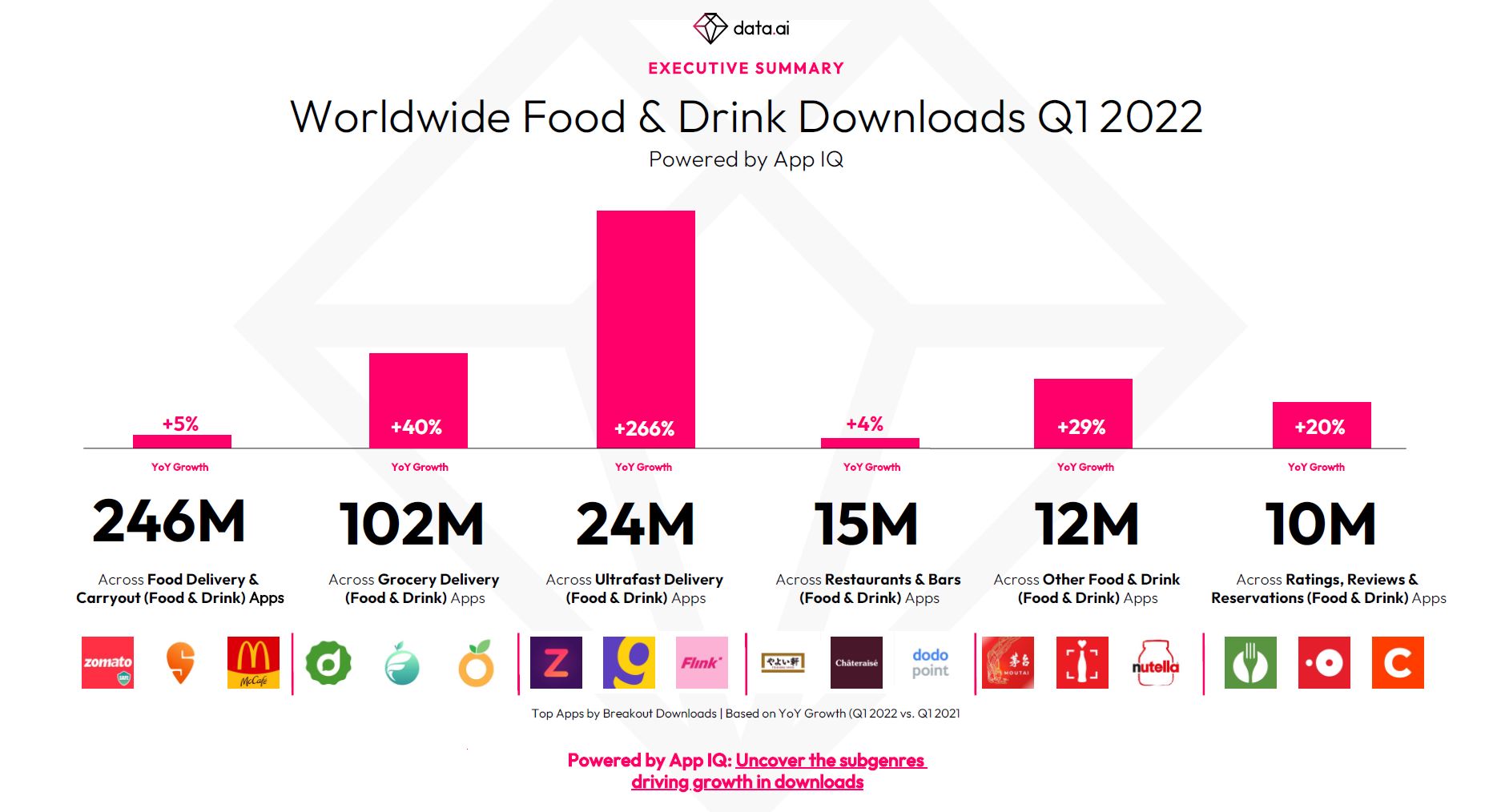

Food Delivery & Carryout apps continue to account for the largest share of total downloads and sessions of any subgenre among Food & Drink apps, with 246m downloads, and a 28 per cent increase in sessions YoY. Grocery Delivery apps represented one in four Food & Drink app downloads in Q1 2022 for a total of 102m downloads. They experienced phenomenal 40 per cent YoY growth. Engagement grew even faster, with total sessions up 70 per cent YoY to 8.6bn globally. Ultrafast Delivery apps saw the strongest YoY growth of 266 per cent (in downloads) and 213 per cent (in sessions) globally, driven by fast movers like Zepto, Getir and Flink. However, Ultrafast Delivery apps still only accounted for 6 per cent of Food & Drink downloads worldwide in Q1 2022, leaving plenty of room, and potential, for new entrants.

Food Delivery & Carryout apps continue to account for the largest share of total downloads and sessions of any subgenre among Food & Drink apps, with 246m downloads, and a 28 per cent increase in sessions YoY. Grocery Delivery apps represented one in four Food & Drink app downloads in Q1 2022 for a total of 102m downloads. They experienced phenomenal 40 per cent YoY growth. Engagement grew even faster, with total sessions up 70 per cent YoY to 8.6bn globally. Ultrafast Delivery apps saw the strongest YoY growth of 266 per cent (in downloads) and 213 per cent (in sessions) globally, driven by fast movers like Zepto, Getir and Flink. However, Ultrafast Delivery apps still only accounted for 6 per cent of Food & Drink downloads worldwide in Q1 2022, leaving plenty of room, and potential, for new entrants.

In-app features

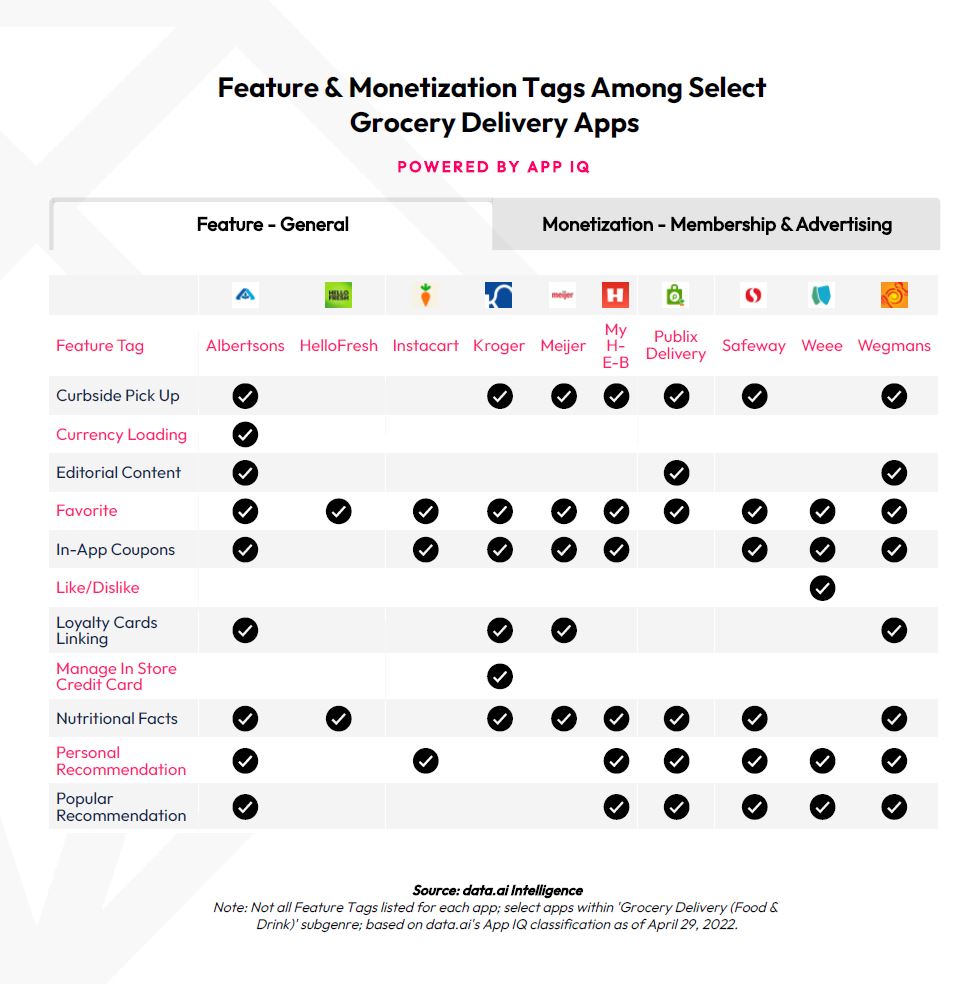

App IQ’s Feature Tags allow app marketers to go even deeper and compare detailed in-app features. Using Feature Tags in the State of Food & Drink report , we discovered what features are table stakes for Grocery Delivery apps, and which offer a competitive advantage.

Albertsons, HelloFresh and Instacart all offer a Recurring Order feature, and our data suggests that this could be a key feature in driving engagement and retention, leading to increased basket sizes and conversions. Compared to its peers, Instacart saw 2x more sessions on average per user than the top 10 grocery delivery apps. More ‘digital foot traffic’ and a large audience (#2 by MAU) can translate to greater sales. The Recurring Order feature taps into the convenience customers now expect, and keeps them coming back. In fact, HelloFresh saw the highest 30-day retention rate among top grocery delivery apps.

Albertsons, HelloFresh and Instacart all offer a Recurring Order feature, and our data suggests that this could be a key feature in driving engagement and retention, leading to increased basket sizes and conversions. Compared to its peers, Instacart saw 2x more sessions on average per user than the top 10 grocery delivery apps. More ‘digital foot traffic’ and a large audience (#2 by MAU) can translate to greater sales. The Recurring Order feature taps into the convenience customers now expect, and keeps them coming back. In fact, HelloFresh saw the highest 30-day retention rate among top grocery delivery apps.

Top brick & mortar Grocery Delivery apps like Publix Delivery and Safeway monetize via a blend of advertising and subscription, in contrast to players like Meijer, who currently offer same-day delivery, subject to a minimum order value.

In terms of demographics, globally, Gen Z prefer Fast Casual apps and new entrants, while Gen X and Baby Boomers skew towards Grocery Delivery apps. In the US. The op app used by Millennials was DoorDash, who were also keen users of coffee QSR apps.

Top Food & Drink Apps globally

The top 10 Food & Drink apps globally by MAU numbers in Q1 2022 were exactly the same as in Q1 2021, though there was some switching of positions. Grab was in first place (as in Q1 2021); UberEats in second (as in Q1 2021) Zomato in third (4th in Q1 2021); Foodpanda in fourth (3rd); Swiggy in fifth (6th); and iFood Delivery de Comida in sixth (5th). The final four places were as in Q1 2021, with McDonald’s in seventh, DoorDash in eighth, Yelp in ninth, and Rappi in tenth place.

The rising stars in Q1 2022 in terms of breakout downloads were Too Good To Go in first place; Rappi in second; CookPad International in third; HelloFresh in fourth; and Astro in fifth.

For a more detailed breakdown of all these insights, and many more, download the report today here.