Mobile bounces back – the story of the global app market in H1 2023

Lexi Sydow, Head of Insights at data.ai, looks at the key findings of the company’s analysis of the H1 mobile app market.

Data.ai’s H1 analysis of the mobile app market, released recently, brought encouraging news for app marketers. After a decline in mobile consumer spend in 2022, spending on and in apps rose by a healthy 5.3 per cent year-on-year in H1 2023 to $67.5bn. iOS consumer spend climbed 5.8 per cent year-on-year to $43.5 bn, while Google Play grew 4.3 per cent to $24bn.

Data.ai’s H1 analysis of the mobile app market, released recently, brought encouraging news for app marketers. After a decline in mobile consumer spend in 2022, spending on and in apps rose by a healthy 5.3 per cent year-on-year in H1 2023 to $67.5bn. iOS consumer spend climbed 5.8 per cent year-on-year to $43.5 bn, while Google Play grew 4.3 per cent to $24bn.

iOS accounts for nearly 65 per cent of total app store spend, and the figure is even higher in purely non-gaming apps, where iOS represents 71 per cent of all expenditure. TikTok continues to be a unicorn in terms of consumer spending outside of games with 31 per cent growth year-on-year, while other apps that rely on subscriptions, such as Disney+, YouTube and Duolingo also delivered solid growth, at 33 per cent, 39 per cent and 48 per cent, respectively.

TikTok, in fact, became the first app to surpass $1bn in consumer spend in Q1, 2023, and naturally it also became the first app to surpass $2bn in a half-year, racking up $2.1bn in consumer spending in H1 2023. This was an increase of 24 per cent from its previous record of $1.7bn in H2 2022.

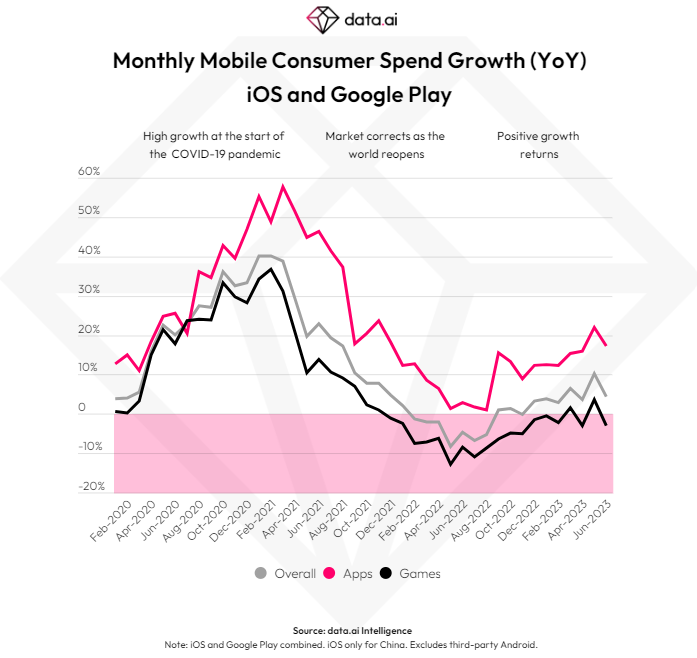

Spending in apps rose by 16 per cent, while spend in games remained roughly even. While this may not seem too encouraging, recent trends suggest that growth in games is likely just around the corner. The sector saw positive year-on-year growth in both March and May 2023 after hitting its low at -13 per cent in May 2022.

Spending in apps rose by 16 per cent, while spend in games remained roughly even. While this may not seem too encouraging, recent trends suggest that growth in games is likely just around the corner. The sector saw positive year-on-year growth in both March and May 2023 after hitting its low at -13 per cent in May 2022.

In terms of categories, Games, Entertainment and Social were the largest categories by consumer spend Among categories with at least $500m in consumer spend in H1 2023, Productivity (32 per cent), Business (27 per cent) and News & Magazines (25 per cent) had the strongest year-over-year growth.

Downloads increasing

App downloads across iOS and Google Play were also up by 3.2 per cent at 76.8bn. While Google Play still accounts for more than three times as many app downloads as iOS, growth was faster on iOS; installs grew 10 per cent year-on-year to more than 18bn. On Google Play, installs grew 1.4 per cent year-on-year to 58.7bn.

On a category basis, Games, Tools and Social were the largest in terms of downloads. Meanwhile, Games, Productivity and Tools saw the most growth in absolute downloads half-year-over-half-year (HoH). For percentage growth, the top performers were Productivity, Books & Reference and Health & Fitness. They posted HoH rises of 16 per cent, 7 per cent and 5 per cent, respectively.

One game that caught the eye in H1 was Gardenscapes, a match-3 title from Playrix. After its consumer spending declined during much of 2021 and 2022, the game bounced back in a big way in the first half of this year. Global consumer spend surpassed $94m in May 2023, surpassing its previous high from three years prior in May 2020. Gardenscapes moved up 11 positions to rank number 8 in by global consumer spend in H1 2023 and it climbed more than 50 spots to rank among the top 10 by downloads.

Gardenscapes joined two other match-3 games among the top 10 by consumer spending (Candy Crush and Royal Match). The Match genre ranked #3 behind only RPG and Strategy genres by global consumer spend in H1 2023.

Looking at growth by categories since H1 2019 reveals that the impact of COVID-19 has continued to normalize, but not disappear completely. For example, Travel & Navigation app downloads are up 13 per cent from H1 2019, although this was still outpaced by the 21 per cent growth from apps overall (excluding games).

The top five games by downloads in H1 2023 were the same as the second half of 2022, with Subway Surfers and Free Fire leading the way. New entrants included Block Blast Adventure from Hungry Studio and Attack Hole from Homa.

The top mobile games by monthly average users were similar to H2 2022, led by ROBLOX, Free Fire and Candy Crush Saga. The only new entrant to the top 10 was FIFA Soccer, which has maintained momentum built up during the FIFA World Cup in late 2022.

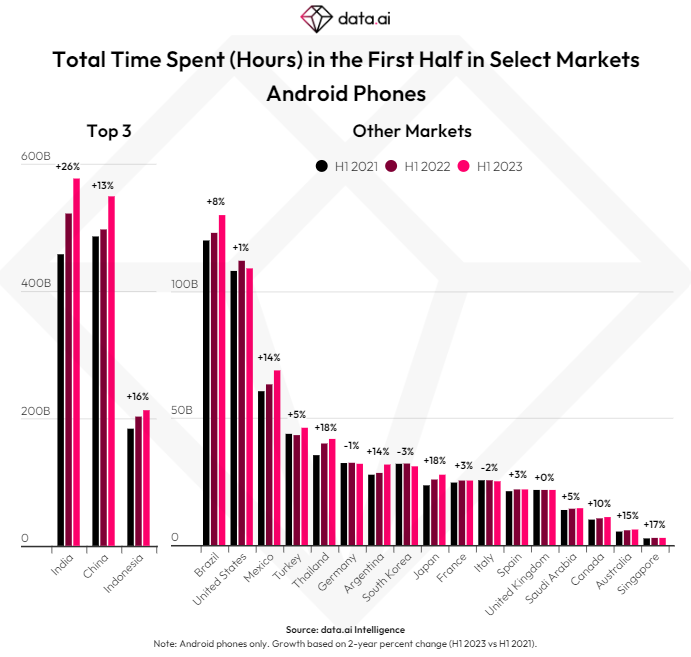

Our analysis also shows that global time spent on mobile also increased in the first half of 2023, rising by 4 per cent to surpass 2.5 trillion hours on Android devices for the first time. In fact, consumers are on track to spend more than 5 trillion hours on Android phones in 2023.

Regional trends

The top three markets by time spent on Android phones were all in APAC, with India leading the way on 26 per cent growth from H1 2021. Other top markets with double-digit growth were China (+13 per cent from H1 2021); Indonesia (+16 per cent); Mexico (+14 per cent); and Thailand (+18 per cent). Time spent on mobile increased 1 per cent in the United States over the past two years, a small decline from H1 2022.

While top markets saw substantial growth in terms of time spent, these countries are showing signs of saturation when it comes to adding new users. India, the US and Brazil remained the top three markets for downloads in H1 2023, though all of these markets have seen roughly flat totals over the past two years.

While top markets saw substantial growth in terms of time spent, these countries are showing signs of saturation when it comes to adding new users. India, the US and Brazil remained the top three markets for downloads in H1 2023, though all of these markets have seen roughly flat totals over the past two years.

Interestingly, China was one of the top markets for download growth, climbing 20 per cent since H1 2021 and 17 per cent year-on-year. While mobile game downloads in China continued to decline due to regulations there, this was more than offset by strong growth in categories outside of gaming, such as Tools, Lifestyle and Travel & Navigation. Note that this only includes iOS downloads in China since Google Play is not available there. Other top markets with the highest download growth over the past two years included Argentina and Mexico, as well as Indonesia and Turkey.

India, Brazil and Indonesia were the largest markets for downloads on Google Play in H1, while Turkey, Russia and Indonesia saw the biggest upwards movement versus H2 2022 on the platform. Whereas on iOS, China, the US and Japan were the top markets by downloads with Brazil, China and the US posting the most growth versus H2 2022.

Reflecting the global trend, many of the top markets that had seen a decline in consumer spend in H1 2022 saw a bounce back in H1 2023. These included the US, UK, Mexico, Turkey, France, Indonesia and South Korea.

Other trends

Chinese apps like ByteDance-owned TikTok and CapCut and PDD Holding’s (owner of Pinduoduo) Temu saw rapid adoption in America and APAC. CapCut, TikTok and Temu ranked as the number 1, 2 and 5 apps, respectively, by raw year-over-year download growth in H1 2023.

After emerging as a popular new social app in the US in 2022, BeReal started to catch on in Europe as well. It was among the top five apps by year-on-year download growth in H1 2023 in France, Germany and Italy.

Governments needed creativity to safely provide services while social distancing during COVID-19, and many launched mobile apps to help. The success of these apps led governments to roll-out additional mobile apps for other services, including MyGov Australia (the number 1 breakout app in Australia), ThaiID (the number 1 breakout app in Thailand), and GOV.UK.ID Check (the number 5 breakout app in the UK).

TikTok’ live shopping app, TikTok Seller, ranked number 4 by breakout downloads in Thailand in H1 2023. The app still remains mostly popular in Southeast Asia, though it recently launched in the US and will be worth monitoring for the rest of the year.

Bumble and Tinder were among the top breakout apps in H1 2023. Bumble, in particular, continued its growth across the globe, including the US, Mexico and Argentina in America; Australia, India and Singapore in APAC; and Germany, Spain and the UK in EMEA.

The video streaming market continues to expand. Disney+ was the top breakout app in Australia and Turkey and number 3 globally. HBP Max, which has rebranded as Max in the US, did particularly well in Latin America.

Reflecting a strong job market in 2023, LinkedIn moved up 12 spots globally to rank among the top 10 apps by consumer spend in H1 2023 compared to a year prior. It was a top breakout app in the US, the UK, Italy, Saudi Arabia and many other countries.

Breakout games

Honkai: Star Rail rocketed to 50m downloads in just 15 days following its release. Since its release in late April through to the end of June, no game had more downloads than Honkai: Star Rail. It also generated almost $230m in consumer spend in its first 30 days. This ranked only behind Pokemon GO in terms of consumer spend in a mobile game’s first 30 days.

Another top new game released in 2023 was Monopoly Go from Scopely. Nearly 40 per cent of its downloads came from Europe. It was the top game overall by downloads in Italy, and number 2 in both France and the UK.

Honkai: Star Rail was joined by some familiar names in the top breakout list. Candy Crush Saga ranked second only to Honor of Kings by total consumer spend in H1 2023. It swept the North America rankings, achieving the top spot by breakout downloads in the US, Mexico and Canada.

Coin Master has a presence in many markets globally. It gets approximately a third of its consumer spend from the US, and no other market contributes more than 10 per cent. It was the top breakout app in Brazil, India, Germany, Spain and the UK.

Finally, following a surge in downloads during the men’s FIFA 2022 World Cup, FIFA Soccer maintained success into 2023. It was particularly popular in some emerging mobile markets in Latin America and Southeast Asia.

Looking for more mobile insights?

Mobile spending is back on the rise, and data.ai has the solutions you need to maximize revenue in this new environment. Total App Revenue is our newest product, providing unprecedented visibility into consumer spending in apps. We’ve leveraged it to create the State of App Revenue 2023, a free, in-depth report exploring the ways mobile publishers can act on spending behavior trends via a holistic view of app monitization. Get it here.